Quattro Inc. Has the Following Mutually Exclusive Projects Available

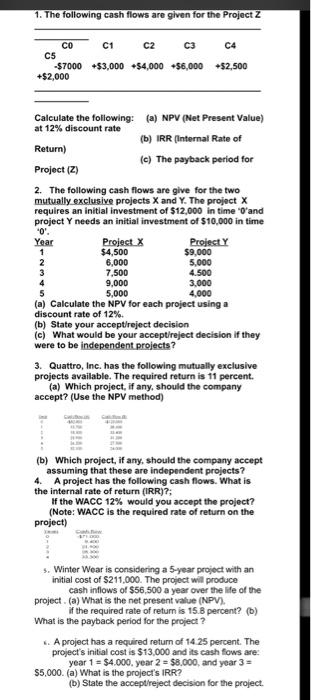

Has the following mutually exclusive projects available. Make sure you submit your sheet with formulas and interest tables.

Peugeot 308 Rcz Dashboard Peugeot 308 Peugeot Cars

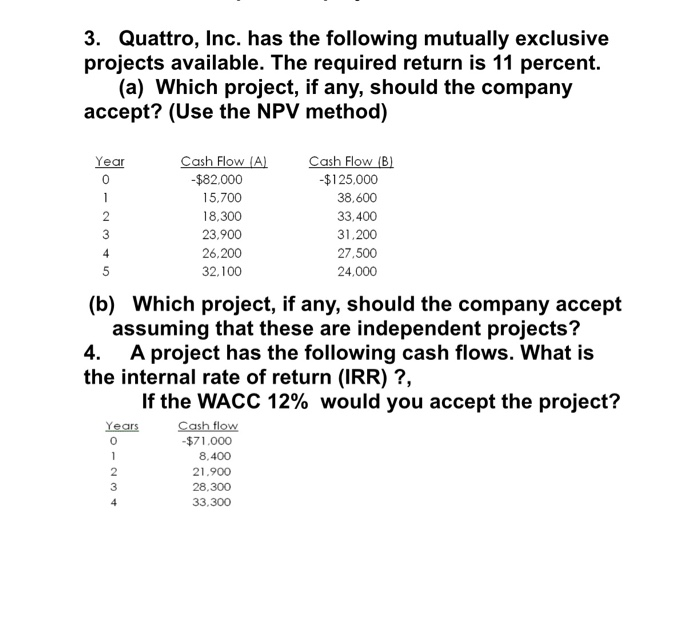

The required return is 11 percent.

. Has the following mutually exclusive projects available. Has the following mutually exclusive projects available. Year Project A Project B.

You can earn 80 points. Maxwell Software Inc has the following mutually exclusive projects. The required return is 11 percent A Flow B 75000 65000 6200 27700 2810024200 432600 15600 The payback for Project A s wh the paybock for Project B s The NPV.

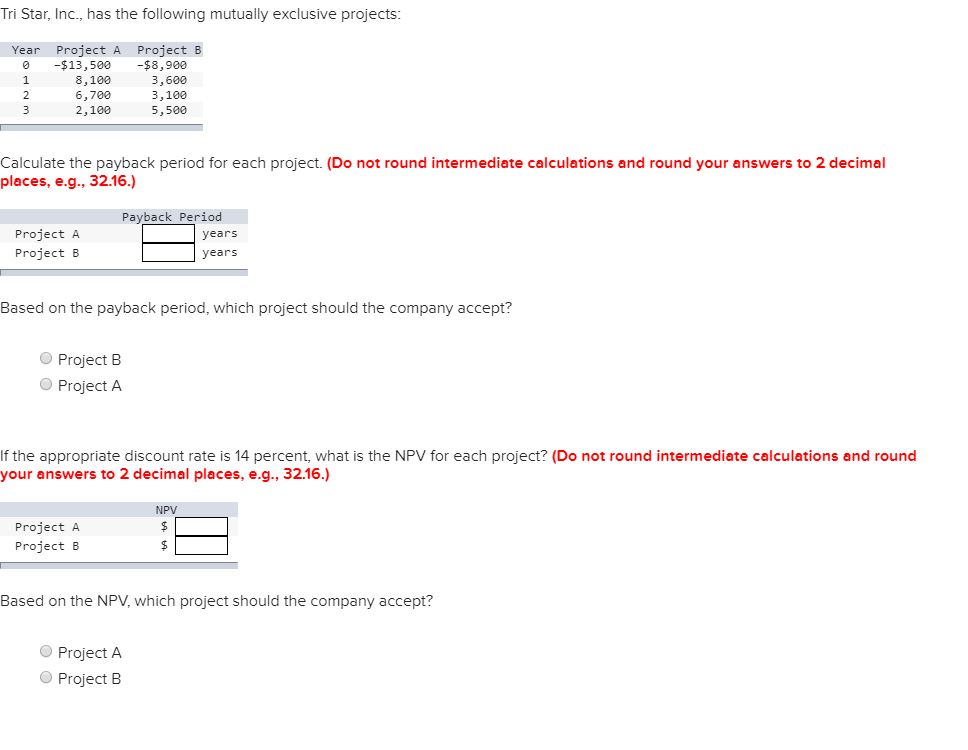

Essentials of Corporate Finance 8th Edition Quiz 19. What are the payback periods for project A and B. Has the following mutually exclusive projects available.

Project F Project G - 138000 - 208000 58500 38500 51500 53500 61500 91500 56500 121500 51500 136500 1 2 3 4 5 a. The required return is 14 percent. Has the following mutually exclusive projects available.

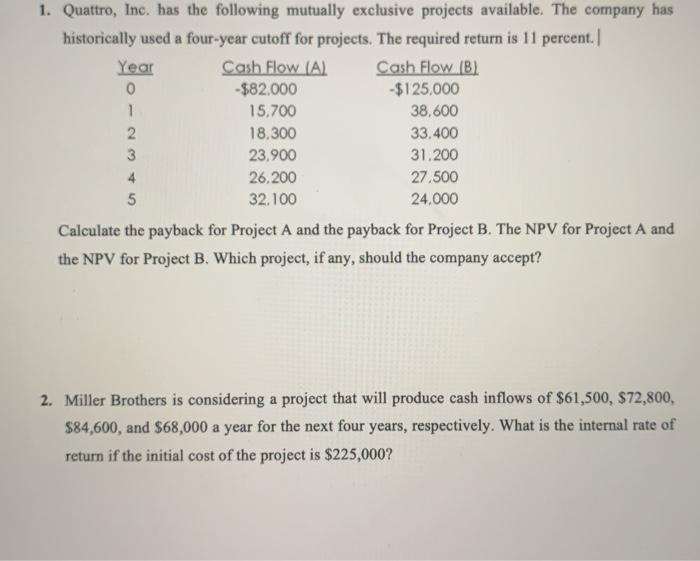

The company has historically used a four-year cutoff for projects. Question Quattro Inc has the following mutuelly exclusve projects available. The company has historically used a three-year cutoff for projects.

Cash payments to shareholders. The required return is 11 percent. FINANCE HOMEWORK ASSIGNMENT problems.

The company has historically used a three-year cutoff for projects. The company has historically used a four-year cutoff for projects. A Which project if any should the company accept.

The required return is 11 percent. The company has historically used a four-year cutoff for projects. Calculate the paybackfor Project A and the payback for Project B.

Has the following mutually exclusive projects available. The required return is 11 percent. 10 Marks Calculate the paybackfor Project A and the payback for Project B.

Has the following mutually exclusive projects available. The payback for Project A is while the payback for Project B is The NPV for Project A is while the NPV for Project Bis. Has the following mutually exclusive projects available.

Has the following mutually exclusive projects available. The required return is 11 percent. The company has historically used a four-year cutoff for projects.

Compute net present value and recommend better project. The company has historically used a four-year cutoff for projects. Accept Project B only B 396 years.

The required return is 11 percent. The required return is 13 percent Year Project FProject G -S127000 197000 44000 59000 86000 116000 131000 64000 46000 56000 51000 46000 a. Has the following mutually exclusive projects available.

The company has histoncally used a four-year cutoff for projects. Has the following mutually exclusive projects available. During the year the firm sold assets with a total book value of 13600 and also recorded 14800 in depreciation expense.

The required return is 11 percent. How much did the company spend to buy new fixed assets. The company has historically used a fouryear cutoff for projects.

The NPV for Project A is _____ while the NPV for Project B is ____. The company has historically used a 4-year cutoff for projects. Which project if any should the company accept.

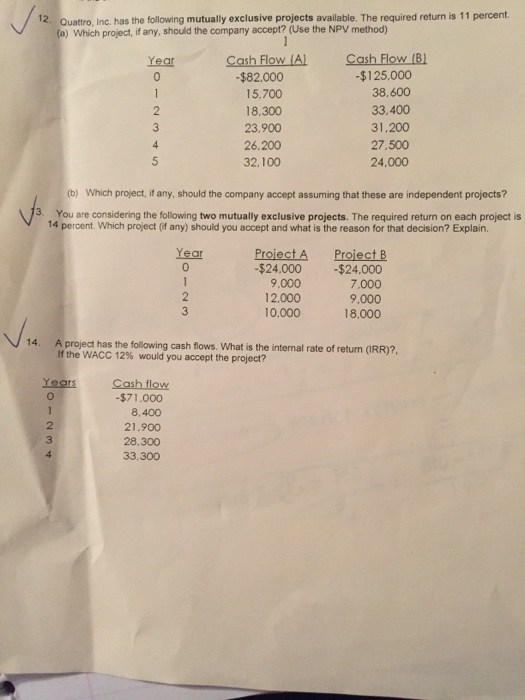

Use the NPV method 1 5 Year Cash Flow A Cash Flow B 0 -82000 -125000 15700 38600 2 18300 33400 3 23900 31200 4 26200 27500 32100 24000 b Which project if any should the. Which project if any should the company accept. The required return is 11 percent.

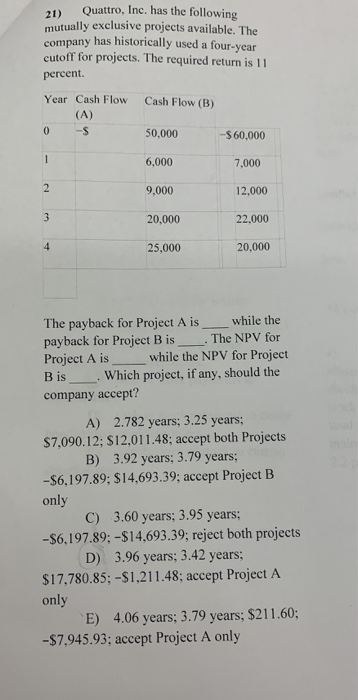

Year Cash Flow A Cash Flow B 0 50000 60000 1 6000 7000 2 9000 12000 3 20000 22000 4 25000 20000 The payback for Project A is ____ while the payback for. The NPV for Project A and the NPV for Project B. The payback for Project A is ____ while the payback for Project B is ____.

Each multiple-choice question is for 2 points. The required return is 11 percent. The company has historically used a four-year.

The company has historically used a 4-year cutoff for projects. The required return is 11 percent. Up to 256 cash back Quattro Inc.

A Which project if any. Calculate the payback period for both projects. What are the payback periods for project A and B.

The company has historically used a 4-year cutoff for projects. Has the following mutually exclusive projects available. Abiword HTML Document 1.

Platos Foods has ending net fixed assets of 84400 and beginning net fixed assets of 79900. Cash flow A Cash flow B 0 -54000 -23000. Has the following mutually exclusive projects available.

The required return is 14 percent. Has the following mutually exclusive projects available. Otherwise the grade will not be given.

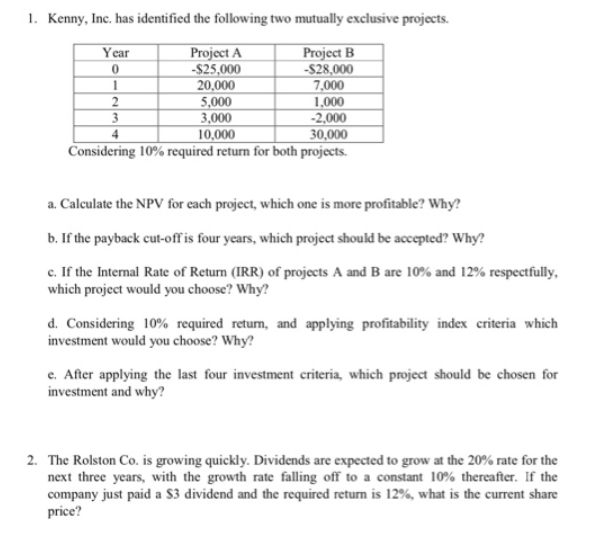

Kaleb Konstruction Inc has the following mutually exclusive projects available. The NPV for Project A and the NPV for Project B. Has the following mutually exclusive projects available.

Has the following mutually exclusive projects available. The required return is 11 percent. The company has historically used a 25-year cutoff for projects.

The required return is 11 percent. Compute the payback for both projects and choose better one. Year Kaleb Konstruction Inc has the following mutually exclusive projects available.

Miller Brothers is considering a project that will produce cash inflows of 61500 72800 84600 and 68000 a. The required return is 11 percent. The required return is 14 percent.

The company has historically used a 25-year cutoff for projects. The company has historically used a four-year cutoff for projects. Cash flow A Cash flow B 0 -54000 -23000.

Up to 256 cash back Quattro Inc. The company has historically used a four-year cutoff for projects.

Solved 1 Quattro Inc Has The Following Mutually Exclusive Projects Available The Company Has Historically Used A Four Year Cutoff For Projects Course Hero

Solved 3 Quattro Inc Has The Following Mutually Exclusive Chegg Com

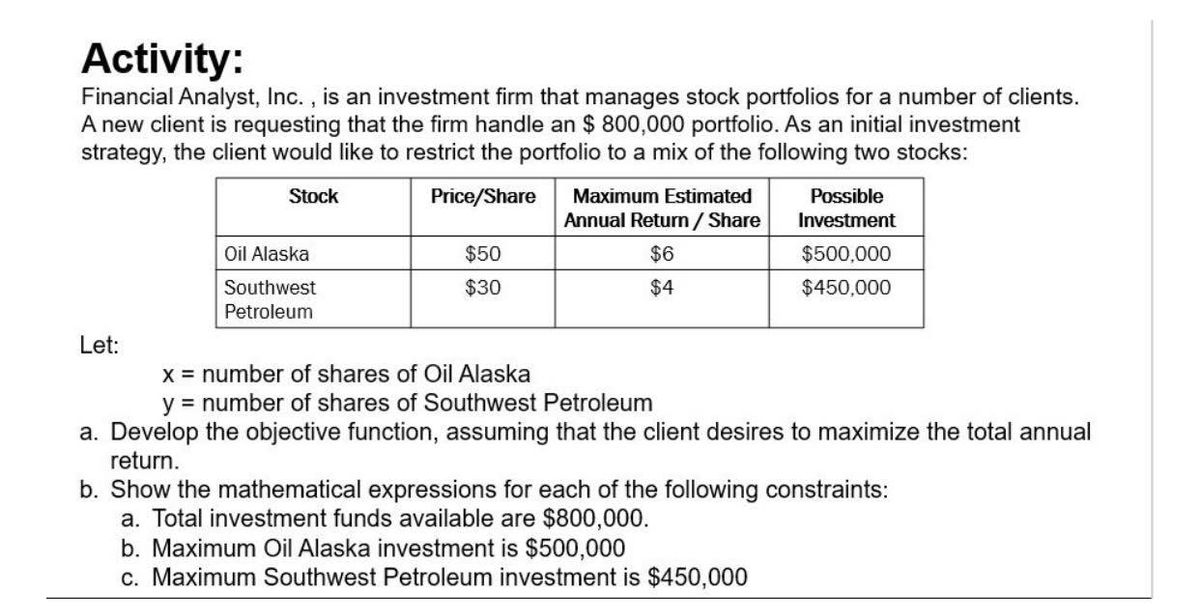

Answered Activity Financial Analyst Inc Is Bartleby

Solved 1 Quattro Inc Has The Following Mutually Exclusive Chegg Com

Nike Thermasphere Max Men S Training Trousers Nike Store Uk Inspiration Bemisbags Details Activewear Details Menswear Details Sport Fashion

Finance Exam 4 Chapter 8 Math Flashcards Quizlet

Solved 21 Quattro Inc Has The Following Mutually Chegg Com

Solved 1 The Following Cash Flows Are Given For The Project Chegg Com

Finance Exam 4 Chapter 8 Math Flashcards Quizlet

Solved 12 Quattro Inc Has The Following Mutually Chegg Com

Answered 1 Kenny Inc Has Identified The Bartleby

Solved Tri Star Inc Has The Following Mutually Exclusive Chegg Com

Solved Quattro Inc Has The Following Mutually Exclusive Chegg Com

Finance Exam 4 Chapter 8 Math Flashcards Quizlet

Bdc Audi Q5 Stealthprjkt Static Rotiform Matt Black Bdc Balls Deep Crew Stanceworks Audi Q5 Rotiform Audi

Comments

Post a Comment